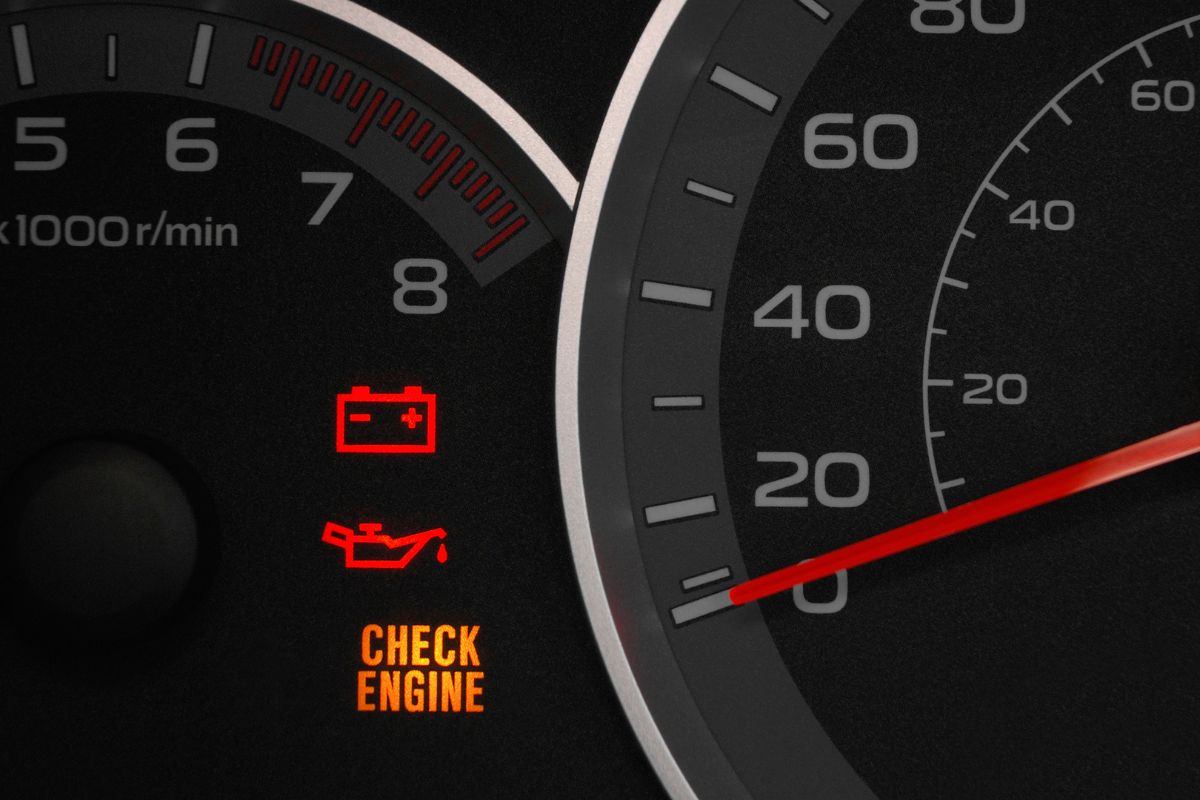

You’re already running late for an important meeting when it happens. That tiny orange engine icon blinks to life on your dashboard, and your heart sinks. As repair costs flash through your mind, you wonder if your insurance will help with whatever’s wrong.

The answer might surprise you, and it’s something every driver should know before they find themselves stranded.

The Moment Every Driver Dreads

It always seems to happen at the worst possible time. You’re driving to work, picking up the kids, or heading out of town for the weekend when suddenly your dashboard delivers the news no driver wants to see.

That innocent-looking check engine light transforms your day in an instant. Your mind races with questions: How serious is it? Can I make it to my destination? How much is this going to cost?

And then comes the question that matters most: Will my insurance help cover whatever’s wrong?

The Answer Most Drivers Don’t Expect

Here’s the reality that often catches people by surprise: Your standard auto insurance policy typically won’t cover engine problems or mechanical failures.

This comes as a shock to many. After all, you faithfully pay your premiums, maintain good driving habits, and expect protection when things go wrong with your vehicle.

But auto insurance has a specific purpose. It’s designed to cover sudden, unexpected events like:

- The fender bender in a parking lot

- Hail damage after a severe storm

- A broken window from attempted theft

- A collision with wildlife on a dark road

When it comes to mechanical issues, wear and tear, or engine problems, your policy likely remains silent, leaving you to handle repair costs on your own.

“Here’s the reality that often catches people by surprise: Your standard auto insurance policy typically won’t cover engine problems or mechanical failures.”

Small Light, Big Implications for Your Wallet

One driver pulled into a service center expecting a quick, inexpensive fix for their check engine light. “Just a sensor,” they thought. Three hours later, they stared at an estimate that exceeded their monthly rent payment.

That single dashboard warning can indicate dozens of different problems:

- A simple loose gas cap

- Failing oxygen sensors

- Spark plug issues

- Catalytic converter problems

- Transmission concerns

The repair costs can range from minimal to several thousand dollars. And regardless of the price tag, standard insurance policies view these as maintenance matters, not covered events.

When Your Insurance Might Actually Help

There is one scenario where your insurance could step in: If your check engine light appears directly because of a covered accident.

Picture this: Another driver rear-ends you at a stoplight. The impact seems minor, but a day later, your engine light comes on. The mechanic discovers that the collision damaged an engine sensor or component.

In this specific case, the repair would likely fall under your collision coverage since it resulted directly from the accident.

One driver shared: “After what seemed like a minor accident, my check engine light appeared. The mechanic found that the impact had jarred loose an engine component. Because we could prove it was connected to the accident, insurance covered the full repair.”

Protection Options You Might Not Know About

While your standard policy has limitations, you might have other options:

- Mechanical breakdown insurance functions similarly to an extended warranty, covering certain mechanical failures

- Roadside assistance coverage won’t fix your engine, but can prevent additional costs like towing

- Newer vehicles might still be under manufacturer warranty for major components

- A quick policy review could reveal protection you already have but haven’t needed to use.

Why Ignoring That Light Could Cost You Double

When that warning light first appears, many of us share the same hope: maybe if I ignore it, the problem will fix itself.

Unfortunately, automotive professionals see the same pattern repeatedly. What begins as a manageable repair often escalates into something much more serious when ignored.

An oxygen sensor replacement addressed promptly might cost a few hundred dollars. But drive with that failing sensor for months, and you might find yourself replacing a catalytic converter for several times that amount.

Even worse, continuing to drive with certain engine problems can leave you stranded far from help or cause additional damage to other systems.

“What begins as a manageable repair often escalates into something much more serious when ignored.”

Your Smart Response Plan

Since standard insurance won’t cover most engine issues, here’s how to protect yourself:

- Take a deep breath, then take action instead of hoping the problem will disappear

- Check your gas cap first, as a loose cap is a surprisingly common trigger

- Visit an auto parts store for a free diagnostic scan to identify the specific issue

- Review your vehicle service contract or warranty information

- Get a written estimate before authorizing repairs

- Consider the long-term cost of delayed repairs versus immediate attention

Key Takeaways Every Driver Should Remember

- Standard auto policies don’t cover mechanical failures or regular wear and tear

- Engine problems resulting directly from covered accidents may be included in claims

- Addressing warning lights promptly almost always costs less in the long run

- Understanding your policy limitations helps you prepare financially for repairs

“Your vehicle represents more than transportation. It’s independence, safety, and often one of your largest investments.”

A Friendly Reminder

Your vehicle represents more than transportation. It’s independence, safety, and often one of your largest investments. While insurance can’t protect against every automotive challenge, knowing exactly what your policy covers lets you plan wisely for the moments when that little orange light inevitably makes an appearance.

Take time today to review your coverage options and consider whether additional protection might provide valuable peace of mind the next time your dashboard tries to tell you something.