Insurance Talk That Doesn’t Make You Snooze

We break down the confusing world of insurance with real talk, real stories, and zero boring jargon.

Serving South Carolina, North Carolina, and Georgia

Find What You Need

Featured

-

From Fender Bender to Courtroom: Why Minimum Coverage Isn’t Enough

The Day Everything Changed It was just another busy afternoon on the road. The sun was…

Latest Articles

-

When the City’s Sewer Fails, Who Pays? The Hidden Risk in Your Basement

A city sewer backup can flood your home, but don’t assume insurance will cover it. Learn the hidden risks and how to protect your basement.

-

The Unthinkable Moment That Reveals What Good Drivers Don’t Know

A Friday night intersection crash reveals how minimum auto insurance coverage left two families facing devastating financial consequences and years of legal hell.

-

What the Heck Is an Umbrella Policy, and Do You Really Need One?

You have car insurance. Home insurance. You’re covered, right? But what if a serious accident or lawsuit goes beyond your policy limits? Without umbrella insurance, your savings, home, and the next 20 years of your…

Deductible

The amount you pay out of pocket before your insurance kicks in. Think of it as your skin in the game.

Premium

The money you pay to your insurance company for coverage. it’s like a subscription fee for financial protection.

Liability Coverage

Insurance that pays for damage you cause to others. Because accidents happen, and lawyers are expensive.

Actual Cash Value (ACV)

What your stuff is worth now, after depreciation. Spoiler: it’s less than you think.

Replacement Cost

What it costs to replace your stuff with new items. The better option if you don’t want to downgrade after a loss.

Umbrella Policy

Extra liability coverage that kicks in when your regularpolicies hit their limits. Like a safety net for your assets and income.

Helpful Resources

South Carolina Insurance

North Carolina Insurance

Georgia Insurance

Home Inventory Checklist

Life Insurance Calculator

Auto Coverage Estimator

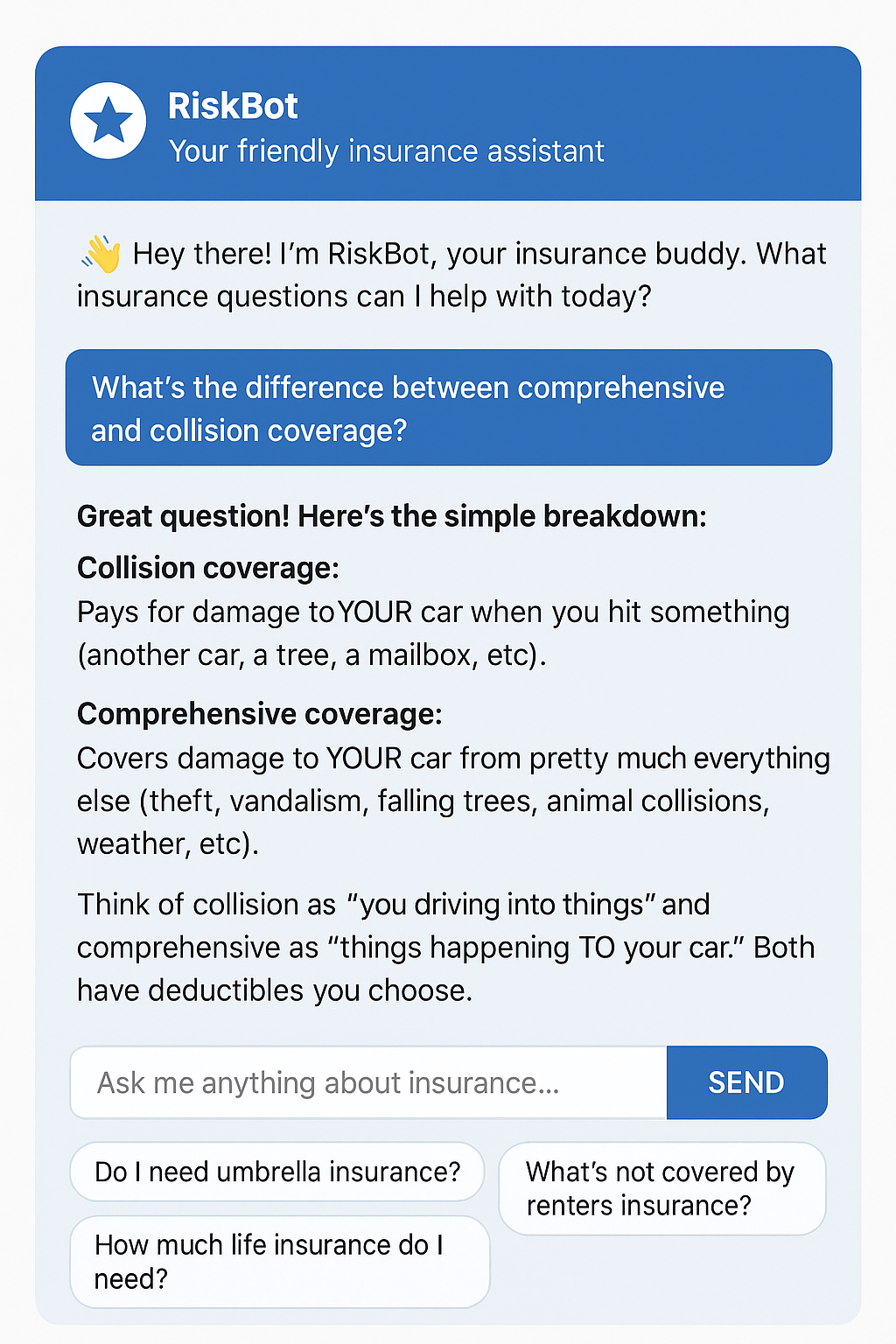

Your new AI assistant for insurance questions is almost here.

Whether you’re confused about liability limits, curious about umbrella protection, or want help explaining your coverages, RiskBot has your back — 24/7.

We’re building a dedicated space just for agents, too.

A private space just for agents with extra tools, FAQs, and access to bonus resources. Whether you’re quoting, explaining coverage, or educating clients, RiskBot will have your back.

Built on Real Information.

No Sales Pitch.

Just Real Talk 24/7.

Here’s How

RiskBot Can

Help You: